RISK MANAGEMENT

At Lasa, we prioritize risk management as a cornerstone of our investment & trading philosophy. Our trading strategies are meticulously designed to be fully hedged, ensuring that potential losses are minimized, even in volatile market conditions.

Why Risk Control Matters?

The financial landscape is filled with volatility. We believe that managing risks at every level ensures stability, security, and the confidence required to seize market opportunities.

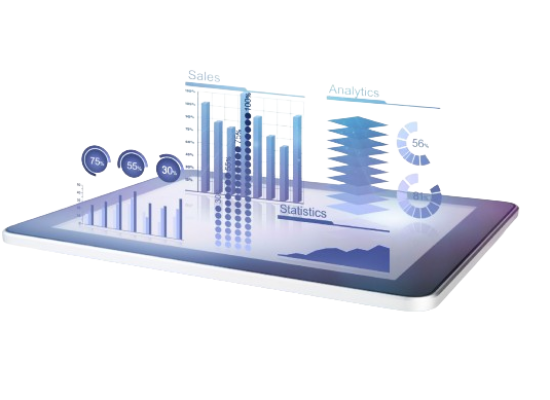

Our proprietary predictive engine plays a crucial role in this risk mitigation process. By analyzing vast amounts of historical data and real-time market trends, our engine provides predictive forecasts and timely trading signals. This data-driven approach enables us to make informed decisions and adjust our positions proactively, safeguarding investments.

Our Commitment

Our commitment to risk management extends beyond hedging strategies. We employ rigorous risk monitoring and control measures to continuously assess and manage potential risks. This proactive approach ensures that your investments remain secure, regardless of market fluctuations.

Our Advanced Risk Control Measures

We leave no stone unturned in implementing cutting-edge technology and robust frameworks to mitigate risks effectively. Here are some of our key measures:

Multiple communication channels

Uninterrupted Power Supply

Server-grade workstations

Real-time backups

Exclusive servers

Automated trading systems

Fail-safe order management systems

100% automation

Dedicated technical teams

Backup terminals

Why Choose Us?

-

Client-Centric Approach

We focus on tailoring solutions to fit your financial goals.

-

Robust Technology

From automated systems to data security, we leverage advanced technology at every level.

-

Experienced Professionals

Our technical and financial experts are committed to your success.